Organised by Chapter Zero France in collaboration with Deloitte.

Date: 30/06/2021

Three takeaways

- Divestment was until recently naively seen as a way to get rid of the problem of an aging asset. However it is an increasingly criticized method. Offloading the problem to someone else is not an acceptable option anymore. There are significant inconsistencies from one country to the other, but it is not enough to comply with local regulations: the media test and the risk of litigation remain essential elements that can harm reputation.

- There is a high need for the industry to develop common standards. Currently, regulation is changing rapidly and uncertainty prevails.

- Boards of directors should keep decommissioning issues top of mind. Directors should ensure all details of the decommissioning process are checked thoroughly, including the evolution of liabilities, size of decommissioning, local regulation, scenario planning, etc.

A one-pager summary of the session by ShARE is available for Chapter Zero France members. If interested, please contact us.

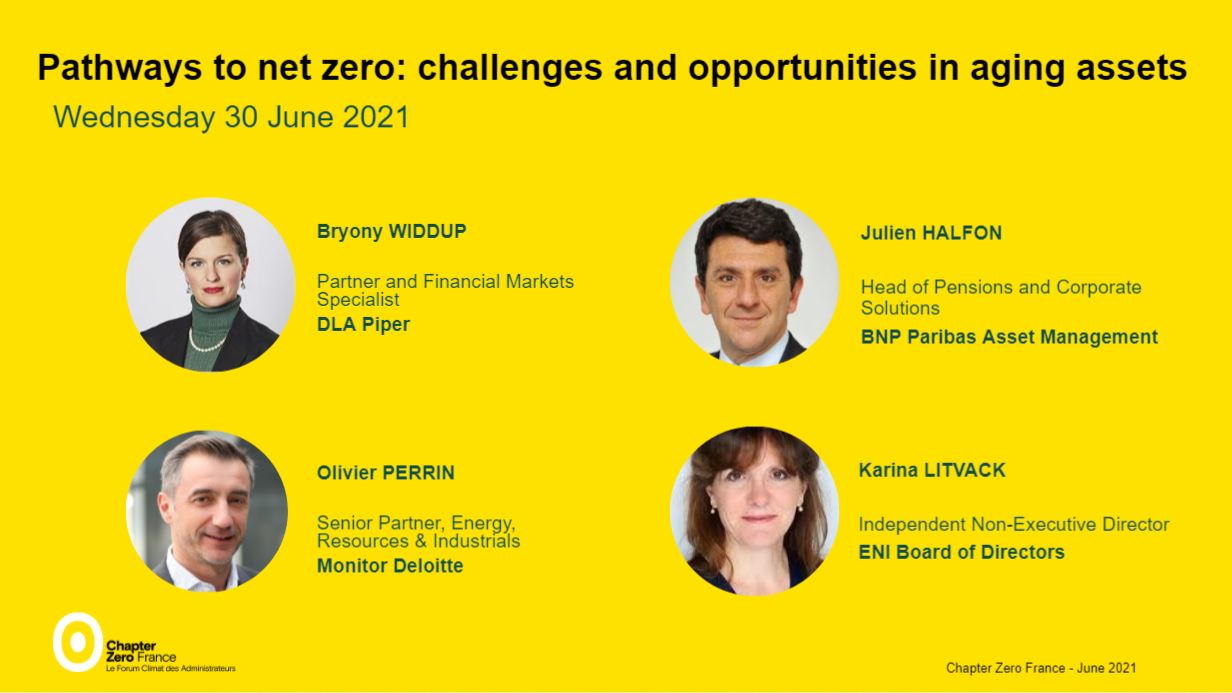

Webinar speakers

Speakers

- Bryony Widdup, Partner and financial markets specialist, DLA Piper

- Julien Halfon - Head of Pensions and Corporate Solutions, BNP Paribas Asset Management

- Olivier Perrin - Senior Partner, Energy, Resources & Industrials, Monitor Deloitte

Moderator

- Karina Litvack - Independent non-executive Director, ENI S.p.A.